Understanding capital gains tax in real estate is crucial for maximizing returns. Short-term holdings face regular income tax rates while long-term gains benefit from lower brackets. Strategic planning, including depreciation and staying current with tax laws, minimizes taxes. Varied jurisdiction tax laws impact gain distribution, requiring investors to use trusts or partnerships for optimization. Staying informed about legislative changes is vital for effective real estate investment.

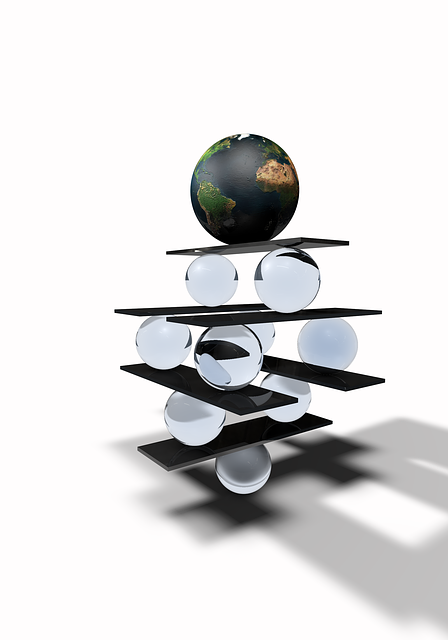

In the dynamic world of real estate, balancing capital gains and taxes is a crucial strategy for investors. This article guides you through the intricacies of understanding capital gains tax, offering valuable insights into minimizing your tax burden on properties. From legal considerations to optimal gain distribution, discover expert strategies to navigate this complex landscape effectively. Maximize your returns while staying compliant—essential reading for any real estate enthusiast.

Understanding Capital Gains Tax in Real Estate

In the world of real estate, understanding capital gains tax is crucial for maximizing returns on investments. Capital gains tax applies when you sell a property for more than its original purchase price, and it’s important to consider this early in the investment process. The tax can significantly impact your overall earnings, especially for those who frequently buy and sell properties.

When navigating real estate investments, keep in mind that the capital gains tax rate varies based on how long you’ve owned the property. Short-term holdings are taxed at regular income tax rates, while long-term gains (held for over a year) usually enjoy lower tax brackets. This distinction is vital for planning and strategizing your real estate transactions to optimize both financial goals and legal obligations.

Strategies to Minimize Tax Burden on Properties

When it comes to balancing capital gains and taxes in real estate, minimizing your tax burden is a key strategy for maximizing returns. One effective approach is to take advantage of depreciation. Depreciation allows investors to deduct the cost of wear and tear on property over time, reducing taxable income. This is particularly beneficial for older properties or those with significant structural elements.

Additionally, staying informed about tax laws and regulations can offer valuable insights. Tax breaks and deductions specific to real estate investments, such as mortgage interest, property taxes, and certain expenses related to rental activities, can significantly reduce taxable gains. Consulting with a financial advisor who specializes in real estate is also advisable. They can provide tailored strategies, ensuring you leverage all available tax benefits while navigating the complexities of the tax code efficiently.

Legal Considerations for Optimal Gain Distribution

When it comes to balancing capital gains and taxes in real estate investments, understanding legal considerations is paramount. Different jurisdictions have varying tax laws and regulations that can significantly impact how and when capital gains are taxed. Investors should be aware of these rules to optimize their gain distribution. For instance, some countries offer favorable tax treatments for long-term holdings or specific types of properties, allowing investors to defer taxes or benefit from reduced rates.

Knowing the legal framework enables strategic planning. This may involve structuring investments through trusts or partnerships, taking advantage of tax-efficient retirement accounts, or employing loss harvesting strategies to offset gains. Staying informed about legislative changes is also crucial, as tax laws can evolve, potentially altering the optimal timing and methods for realizing capital gains in real estate.